Tesla Stock: A Comprehensive Overview

Introduction

Tesla stock is a highly sought-after investment in the automotive industry, attracting both retail and institutional investors. In this article, we will provide an in-depth analysis of Tesla stock, covering its types, popularity, quantitative measurements, differences between various types of Tesla stock, and a historical review of their advantages and disadvantages.

1. Overview of Tesla Stock

Tesla stock refers to shares of ownership in Tesla Inc., the renowned electric vehicle manufacturer founded by Elon Musk. As a publicly-traded company, Tesla offers its stocks on the Nasdaq exchange under the ticker symbol TSLA. Tesla stock provides investors with an opportunity to participate in the financial performance of the company and potentially benefit from its growth and profitability.

2. Types of Tesla Stock

Tesla offers common stock, which is the most common form of equity ownership. Common stockholders are entitled to voting rights and can participate in the company’s decision-making processes. Additionally, Tesla has also issued preferred stock, which grants certain advantages over common stock, such as priority in dividend payments and liquidation preferences. Preferred stockholders usually forego voting rights in exchange for these benefits.

In terms of popularity, Tesla’s common stock is the most widely traded and well-known. It represents a direct ownership interest in the company and attracts both individual investors and institutional investors, such as mutual funds and pension funds.

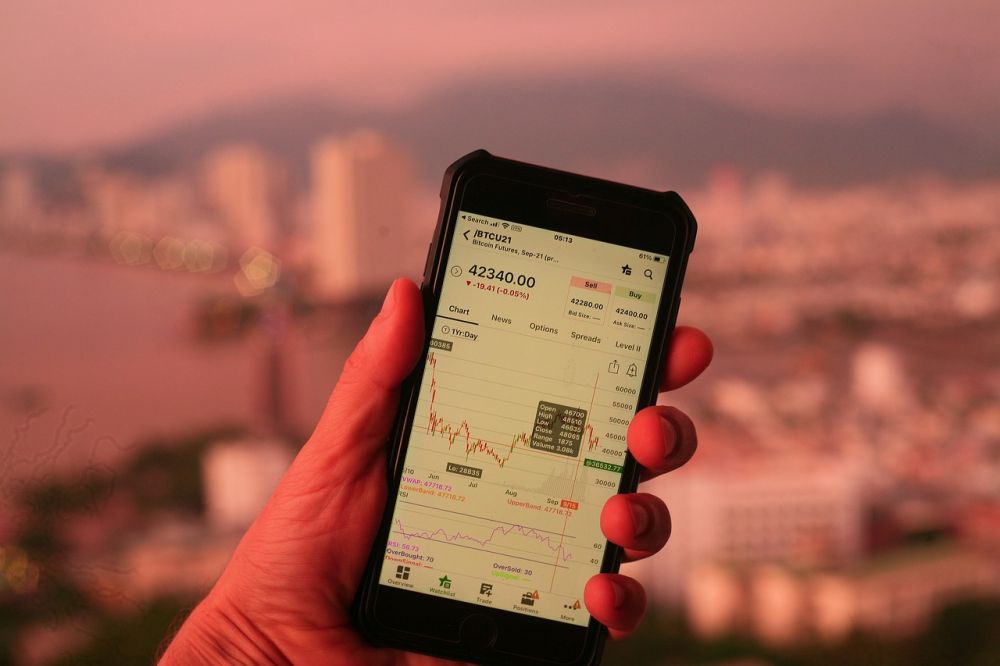

3. Quantitative Measurements of Tesla Stock

To assess the performance of Tesla stock, various quantitative measures are employed. Key metrics include market capitalization, price-to-earnings ratio (P/E ratio), and revenue growth.

a. Market Capitalization: Market capitalization, or market cap, is calculated by multiplying the current stock price by the number of outstanding shares. It represents the total value of a company as perceived by the market. As of [INSERT DATE], Tesla’s market cap stood at [INSERT VALUE], making it one of the most valuable automakers globally.

b. Price-to-Earnings Ratio: The P/E ratio is a valuation metric that compares the price of a stock to its earnings per share (EPS). It provides insight into how much investors are willing to pay for each dollar of earnings generated by the company. Tesla’s P/E ratio has historically been higher than its peers, reflecting high growth expectations.

c. Revenue Growt Tesla’s revenue growth has been a significant driver of its stock performance. The company has consistently reported impressive revenue growth, mainly fueled by increased vehicle deliveries and expansion into new markets. Strong revenue growth is often viewed positively by investors, as it suggests the company’s ability to generate income.

4. Differences between Tesla Stock Types

While all Tesla stock represents ownership in the same company, different types of stock can have varying rights and privileges. For example, common stockholders have voting rights and the potential for capital appreciation, whereas preferred stockholders have priority in dividend payments. The choice between common and preferred stock often depends on the investor’s objectives and risk appetite.

Moreover, Tesla has also issued multiple classes of common stock, namely Class A and Class B shares. Class A shares have one vote per share, while Class B shares have ten votes per share. This dual-class structure allows Tesla’s management, including Elon Musk, to retain control and make long-term decisions without being easily influenced by external shareholders.

5. Historical Review of Tesla Stock’s Advantages and Disadvantages

Throughout its history, Tesla stock has exhibited both advantages and disadvantages that investors should consider.

a. Advantages:

– Innovation and Disruption: Tesla has revolutionized the automotive industry with its electric vehicles, creating a strong brand and attracting a loyal customer base.

– Growth Potential: Tesla’s focus on renewable energy and autonomous driving technologies positions it for future growth as the world shifts towards sustainable transportation.

– Market Leadership: Tesla is often viewed as the leader in the electric vehicle market, benefiting from first-mover advantage and high brand recognition.

b. Disadvantages:

– Volatility: Tesla’s stock price has experienced significant volatility, influenced by factors such as production challenges, global economic conditions, and regulatory developments.

– Competitive Landscape: Traditional automakers and new entrants continue to intensify competition in the electric vehicle space, potentially diminishing Tesla’s market share.

– Regulatory Risks: As a rapidly growing and innovative company, Tesla is subject to various regulatory risks, including changes in government policies, safety regulations, and possible reductions in electric vehicle incentives.

Conclusion

In conclusion, Tesla stock represents an exciting investment opportunity within the automotive sector. With its various stock types, quantitative measurements, and historical advantages and disadvantages, Tesla stock offers both potential rewards and risks. As an investor, it is essential to conduct thorough research, analyze the company’s financial performance, and assess industry dynamics before making investment decisions.